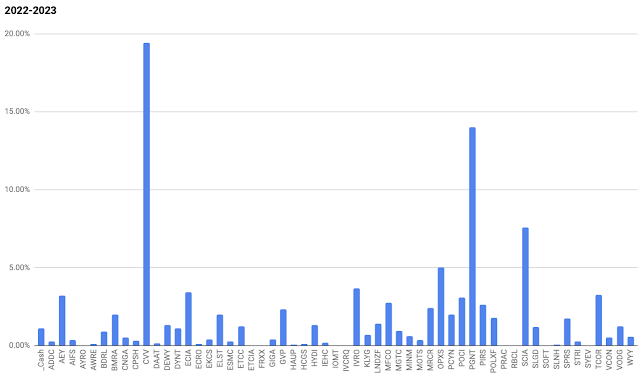

You can read my past annual performance posts here.

Hard to believe it's been 10 years since I first bought a stock. Investing has been one of my most rewarding experiences and definitely one of my best decisions. Without contributing all that much I've grown my retirement fund to nearly 20x what it was when I started. When I started out in stocks I was hoping to beat the market and I have far exceeded that so I'm very, very happy with how it's gone.

In the past 10 years I've made ~10x on a handful of stocks: SIMA, CLSI, TCCO, QDLC. I've made over 500% on a few more: BMRA, HRBR, DPW, COMX. Biggest winner of course was HEMA at around 35x gain. I'm down over 90% on a lot of stocks: GIGA, SOFT, SLGD, MINM, MOTS, VCON, AYRO, IVC, SYEV, SLNH, HAUP, HCGS. What a graveyard!

It's a game of extremes for me, and with all these little stocks on the brink of extinction it makes sense. I'm looking for maximum movement after all. I have a few 100-300% winners I'm riding right now in the hope they continue on up to be life changing returns: CVV, PGNT, POCI, SCIA, OPXS. And of course I keep buying some of these losers with potential to turn it around SLGD, MINM, BDRL, and more.

Thank you all for the conversation. Thanks for reading and making me a better investor. Thank you for the ideas and the criticism.

I will try to write more this year. The past couple years has not been great for my portfolio and that's cascaded into my blog. It's hard to find the motivation and confidence to tell others about a stock when you see your own losers all day.

Below you can find my portfolio:

Now let's look at some stocks

About two years ago change came to CVV. In Jan 2021 the long time CEO and Chairman of the Board was terminated and replaced. A new chairman came on and a new CEO. They started a push towards higher margin products in growth markets and the numbers started to improve last year. The main driver right now is their Silicon Carbide product aimed at high power electronics. Revenue and backlog are moving in the right direction.

Look at that chart. The resistance at 6. The ascending triangle formed over the second half of 2022. It was this news of Silicon Carbide orders that started the move and what an explosion!

The S3 filing a couple weeks ago really muted the stock. I love the commentary in that filing. In fall 2021 they had a $28m real estate sale fall through and this must be the backup funding plan. My hope is they need this cash for growth and it will pay off over the next few years.

The stock has done well since I first bought around $2. I've continued to buy up to the mid-7's I think. It's cheap

Now they are selling off division after division trying to stay afloat. In 2020 SLGD sold off manufacturing operations and terminated the distribution agreement with Montagne Jeunesse. In 2021 they sold Dryel and stopped the Batiste dry shampoo distribution. In 2021 the CEO Goldstein retired and they brought in new management. Hell in Jan 2023 they even sold the wood treatment line which means Scott's Liquid Gold doesn't even own Scott's Liquid Gold!

I'm not sure what to make of all that but it's change on top of change on top of change and that's what I'm after. I've been buying more and will probably continue. Market cap now is around $2.5m. The Company’s remaining brands include Alpha Skin Care, Biz Stain Fighter, Kids N Pets and Messy Pet, Denorex shampoo, Neoteric Diabetic Skin care, and Zincon Shampoo. Book value is $2.8m and I think what they have is worth more than that.

--Dan

disclosure: long all the stocks in my portfolio picture

Subscribe to all NoNameStocks posts here: https://forms.feedblitz.com/erd

Now let's look at some stocks

CVV

I first wrote up CVV at $12 about 8 years ago. It was not a huge position and luckily so because it tanked. I bought more on the way down then wrote it up again at $4 in 2018. I made it one of my largest positions in the 3's and otherwise have just been sitting and waiting. About two years ago change came to CVV. In Jan 2021 the long time CEO and Chairman of the Board was terminated and replaced. A new chairman came on and a new CEO. They started a push towards higher margin products in growth markets and the numbers started to improve last year. The main driver right now is their Silicon Carbide product aimed at high power electronics. Revenue and backlog are moving in the right direction.

Look at that chart. The resistance at 6. The ascending triangle formed over the second half of 2022. It was this news of Silicon Carbide orders that started the move and what an explosion!

The S3 filing a couple weeks ago really muted the stock. I love the commentary in that filing. In fall 2021 they had a $28m real estate sale fall through and this must be the backup funding plan. My hope is they need this cash for growth and it will pay off over the next few years.

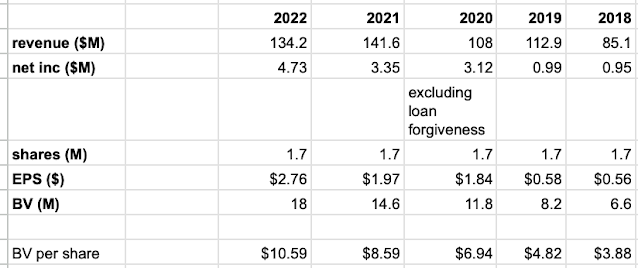

PGNT

This one is just cheap. I don't get it. These numbers tell me about a $20 stock. Right now it's just over $9 meaning PE a little more than 3 and still below book value. An amazing balance sheet with over $3 per share in cash. Look at the growth. Ridiculous. SLGD

Time for a loser and boy oh boy look at that chart. Yuck with a capital Y. I first bought in the mid-1s in 2016 then expertly wrote it up at the absolute peak in early 2018 LOL. 'After' the drop I bought more at a buck in 2019 then watched in glee as it came back up to $3 giving me some wonderful gains I was too smart to lock in. Now they are selling off division after division trying to stay afloat. In 2020 SLGD sold off manufacturing operations and terminated the distribution agreement with Montagne Jeunesse. In 2021 they sold Dryel and stopped the Batiste dry shampoo distribution. In 2021 the CEO Goldstein retired and they brought in new management. Hell in Jan 2023 they even sold the wood treatment line which means Scott's Liquid Gold doesn't even own Scott's Liquid Gold!

I'm not sure what to make of all that but it's change on top of change on top of change and that's what I'm after. I've been buying more and will probably continue. Market cap now is around $2.5m. The Company’s remaining brands include Alpha Skin Care, Biz Stain Fighter, Kids N Pets and Messy Pet, Denorex shampoo, Neoteric Diabetic Skin care, and Zincon Shampoo. Book value is $2.8m and I think what they have is worth more than that.

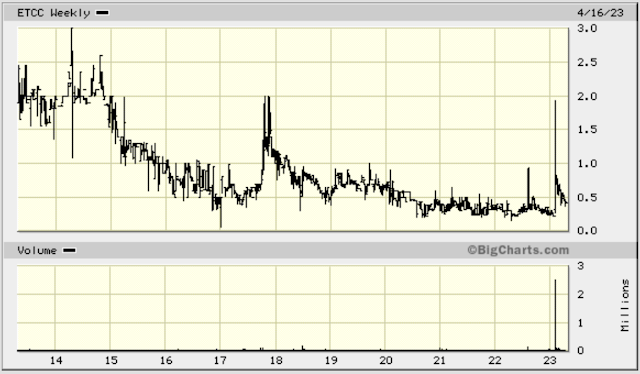

ETCC

Oh you like seeing my losers, well check this! Here is another I'm buying right now. I wrote this one up 3 years ago at $0.58. Covid hit them hard and they didn't file reports for a year. In Jan 2021 they filed 3 Qs and a K then disappeared for another 7 months until coming back to normal filing in Sept 2021. Revenue dropped and times were tough which you can see in the chart.

But what is that spike I see in early 2023? The company announced an $85m contract. Market cap is $4m right now which is less than the quarterly revenue. Book value is almost nothing and the company loses money but only a few years ago revenue was $50m.

I'm surprised the stock dropped back down after the contract announcement. Wait and see I guess. Questions for me are timing and margins which we don't know.

Take it easy. Keep the emails and comments coming. On to the next 10 years!

disclosure: long all the stocks in my portfolio picture

Subscribe to all NoNameStocks posts here: https://forms.feedblitz.com/erd

Dan,

ReplyDeleteNice to see you are still writing a bit. Couple of thoughts. It doesn't necessarily fit your investment mode of holding forever but sometimes you should consider selling and taking the loss. SLGD for example. While there is some value left, when they are basically selling it all off, management tends to eat up whatever value is created. They get paid first no matter what. I learned this lesson more than once.

Would love to see you revisit some of the oldies. For example, HYDI, has dropped in price again but has a new facility and recently fired the longtime CEO. May be getting serious about making some money or putting themselves up for sale?

Also wondering if you have any thoughts about Expert Market names and whether there is any hope of ever getting to trade them again?

thanks Duane. yeah that is some major drama at HYDI with the son taking over from dad then getting ousted!

Deleteon the expert market my hopes are not high. I continue to hold my dark stocks but it's really just waiting for a buyout

First off, thank you Duane, for the HYDL post-- an interesting situation deserving further study. If my preliminary research is positive I’ll consider requesting a phone interview with Martin C. Von Dyck, Chief Operating Officer. Anyone have any questions for the call? Perhaps a conference call? Also, Thanks, Dan, for the update. I’m envious!

Deleteomg even more drama that's his brother isn't it? this is great

Deleteagree HYDI action is interesting. Maybe misguided but I've been buying some more down here recently. something is happening at least

DeleteCongratulations! Your results are spectacular. You are an inspiration to many and always friendly and approachable. Your style offers a different point of view among what is distilled on the internet, all growth and quality. At least it's thought-provoking. Thanks for sharing.

ReplyDeleteCongratulations on your fantastic performance Dan, I wish you many more years of success my friend and look forward to sharing more ideas with you, I've found a few exciting ones recently and will be in touch!

ReplyDeleteRegards,

David (EV)

thanks all

ReplyDeleteKeep it going Dan! You are still absolutely killing it and it is always a pleasure to read your blog.

ReplyDeleteCongratulations Dan. Wish you the best in all that you do.

ReplyDeleteCongrats with these absolutely amazing results! Love your blog.

ReplyDeletethanks everyone it means a lot

ReplyDeleteYour blog is really helpful. Thanks a lot!

ReplyDeletePOLXF acquired. Another W.

ReplyDeleteGreat job Dan! You are an inspiration to me.

ReplyDeleteI have ideas about why Paragon Technologies is so cheap. The majority of the company's earnings come from its SED Columbia subsidiary, which distributes IT equipment in Columbia. This is a high volume, low margin business whose earnings could collapse if the industry changes slightly. The CEO claims that the distribution business is better managed than its competitors, and this may be true. If you own Paragon you are betting that this will continue. Furthermore, Paragon's inventory, most of which is held by SED Columbia, exceeds its book value. IT is a rapidly-changing industry and is precisely the kind of industry in which inventories are subject to sudden write-downs due to unexpected sales reductions or obsolescence. One write-down could wipe away years of earnings and cause book value to drop significantly.

ReplyDeleteIn addition, the CEO has a questionable record of capital allocation. While buying control of the distributor has worked out well so far, he also bought bonds of a distressed oil company which went bankrupt. He has also invested money in Nevada residential real estate at cap rates lower than those which Paragon pays on its Columbia lines of credit, so that the company as a whole is borrowing money at one rate and investing it at a lower rate. This only makes sense if the CEO expects to flip the real estate at a gain, which appears to be his plan. Perhaps it will work, though i real estate prices fall this could reduce book value further. In sum the company is pursuing several risky strategies which may encounter problems or may succeed.

thanks Anonymous I, I had been looking at PGNT so great to know the bear thesis and save myself some time :)

ReplyDeleteMINM also has big issues from last time I looked at it. They are paying away all their profits as royalties to Lenovo

Dan, I've followed you on and off since 2015. I love the fact that you're willing to dig deep into each potential investment and stick to discussing fundamentals, no hype or b.s. Can't wait to see how the next 10 years turn out.

ReplyDeleteI curious, HEMA clearly had a tremendous impact on your overall performance. Have you ever calculated what your overall return vs the S&P would be if you left HEMA out? Just for kicks....

No I haven't done that. In my old annual performance posts I used to post my performance with and without HEMA

DeleteAn interesting benchmark for you would be the Nanocap100 index. The question could be whether you can beat this rather passive nano cap index. This "index" has been moving sideways for some time. https://www.nanocap100.com/charts

ReplyDeleteHi Dan, are you still holding onto CVV? The price has declined significantly since you wrote this due to negative earnings in the first 3 quarters of 2023.

ReplyDeleteAlso, I'm pretty sure you mentioned this elsewhere but what software do you use for charting? Thank you!

yes I still hold all my CVV. didn't sell any though maybe I should have

Deleteusually I use ihub, bigcharts, or fidelity. I talk about it some here: http://www.nonamestocks.com/p/tools.html