Here are the tools I use to track and analyze stocks. Some of these I use daily while others are only for a specific purpose. If you know of others please leave a comment.

Stock Price & News Tracking

The most frequently used tool for me is my Seeking Alpha Portfolio. You can create a portfolio for free and it's the best tracking tool I have found for watching prices, volume, and news through the day. You just have to create an account. I have this page open all day every day in the background at work. I check probably 50 times a day while the market is open. Just a quick open and refresh to see if any of my stocks are spiking and if there's any news. Here's what mine looks like. What I'm looking at always is price, price change in %, volume, and news. At the bottom of the portfolio they do a pretty good job of curating all press releases that are filed at the major news sites (Business Wire, Globe News Wire, etc). I have one portfolio for my holdings which has about 50 stocks and then I have a few other portfolios for groupings of stocks that various people have recommended to me. It's a way of keeping a list of things to check out in the future. This doesn't catch every single press release because some companies will file on their own website or with OTC Markets but it catches all the major outlets.

The most frequently used tool for me is my Seeking Alpha Portfolio. You can create a portfolio for free and it's the best tracking tool I have found for watching prices, volume, and news through the day. You just have to create an account. I have this page open all day every day in the background at work. I check probably 50 times a day while the market is open. Just a quick open and refresh to see if any of my stocks are spiking and if there's any news. Here's what mine looks like. What I'm looking at always is price, price change in %, volume, and news. At the bottom of the portfolio they do a pretty good job of curating all press releases that are filed at the major news sites (Business Wire, Globe News Wire, etc). I have one portfolio for my holdings which has about 50 stocks and then I have a few other portfolios for groupings of stocks that various people have recommended to me. It's a way of keeping a list of things to check out in the future. This doesn't catch every single press release because some companies will file on their own website or with OTC Markets but it catches all the major outlets.

I wake up before market open (that's 6:30am here on the west coast) every day and one of the first things I do is refresh my portfolio. I'm looking for any premarket volume or news. I also check it after market close to see if anything is moving.

I used Yahoo Finance's portfolio for a decade but in the spring of 2024 I switched to Seeking Alpha. I still have my yahoo portfolio and check it for news but I can't use it to track stock movement anymore. They screwed something up and now stocks that don't trade every day still sit at the last trade forever. For example if an illiquid stock goes up 10% one day then doesn't trade for a week, yahoo will still show it up 10% every day.

Filings by email

I use two ways to track SEC and OTC Markets filings: conferencecalltranscripts and capedge. Both are free. What they do is email you automatically whenever a stock you follow has posted a filing or put out a press release.

I use two ways to track SEC and OTC Markets filings: conferencecalltranscripts and capedge. Both are free. What they do is email you automatically whenever a stock you follow has posted a filing or put out a press release.

Every morning when I wake up right away I check my email for filings and press releases.

- Services I use

- conferencecalltranscripts.org

- Sends you an email whenever a stock you follow posts a new SEC or OTC Markets filing. Also sends an email when your stock puts out a press release on one of the major news sites. You can put in a webpage and it will email you when the site is updated.

- This service was developed by Saj Karson and he sold it in late 2023 or early 2024.

- Problem is reliability. This service misses a lot of filings and seems to be getting worse over time. I've talked to the new owner and they are trying to fix but it just doesn't work all the time.

- I believe the way this works is by following the otcmarkets RSS feed feed:https://www.otcmarkets.com/syndicate/rss.xml or https://s3.amazonaws.com/content.otcmarkets.com/syndicate/rss.xml and looking for changes. What I've seen is sometimes that feed just misses certain filings. Other times the filing is there but I don't get an email.

- capedge.com

- This service is rock solid and works great.

- sends you an email when a stock you follow posts a new SEC filing

- problem is this doesn't work for OTC reporting stocks or press releases

- Others I've heard of but don't use

- https://www.theonlineinvestor.com/alerts/

- only supports SEC reporting companies and has 25 stock limit

- Filingre.com

- not free

- looks like it offers a lot of functionality

- scanz.com

- not free

- looks like it offers a lot of functionality

- visualping.io

- a friend told me they use this site to monitor all the otcmarkets stocks news pages to get emails for otc stocks

- I haven't tried it

- google news alerts

- a friend said they use this to catch press releases

Bid/Ask

There are always a handful of stocks I'm thinking about buying. Always. These stocks I follow constantly, checking the bid and ask. For this I use Fidelity. Most brokerages will give you the same info and I use Fidelity just because that's what I have and I like the interface. What I'm watching is the bid price, bid size, ask price, and ask size. Sometimes you see a block of stock available for a price you like and this gives you the chance to snatch it up. This shows whatever is the highest bid and lowest ask.

There are always a handful of stocks I'm thinking about buying. Always. These stocks I follow constantly, checking the bid and ask. For this I use Fidelity. Most brokerages will give you the same info and I use Fidelity just because that's what I have and I like the interface. What I'm watching is the bid price, bid size, ask price, and ask size. Sometimes you see a block of stock available for a price you like and this gives you the chance to snatch it up. This shows whatever is the highest bid and lowest ask.

One issue is it does not always show the small volume bid/asks. I don't know the exact cutoff but for example if there's a bid for 50k shares of some stock at $1 and also a bid for 20 shares at $1.10 it would only show the 50k @ $1 because 20 is not enough.

For example in the screenshot below showing someone wants to buy $289k shares of HCGS at $0.006 and the lowest offer to sell is 40k shares at $0.0086.

There are sites you can pay for a level 2 subscription which will show all bids and asks out there. I have never paid for this so I don't know much about it. OTC Markets does provide level 2 quote trees for some stocks so I will check there from time to time. I think they only do it for stocks on a certain tier. For example see below. The MPID is the market maker. Each entry here is some person offering to buy or sell a certain number of shares at a certain price:

Charts

I look at charts all the time and for that I have a few sources. My favorite is the iHub app on my phone. It has the best looking charts to me.

I also use BigCharts on my laptop for very long range charts. Ihub only goes back 3 years on the phone app. BigCharts will go back decades but sometimes gets screwed up by splits or name changes and in those cases I use Fidelity. I watch charts all day, every day.

I look at charts all the time and for that I have a few sources. My favorite is the iHub app on my phone. It has the best looking charts to me.

I also use BigCharts on my laptop for very long range charts. Ihub only goes back 3 years on the phone app. BigCharts will go back decades but sometimes gets screwed up by splits or name changes and in those cases I use Fidelity. I watch charts all day, every day.

Sometimes the BigCharts chart isn't correct with splits or other things and in that case I'll open it up in Fidelity. Always seems to be right there.

Filings Research

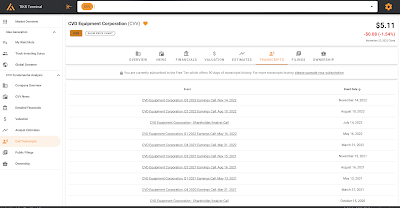

For fundamental research I go straight to otcmarkets. Most stocks I look at are traded OTC. I own some that are SEC reporting and for those you can go straight to the SEC site, but most of my stuff is through otcmarkets and they have SEC reporting stocks as well so I just go there.

On otcmarkets I usually go straight to the Disclosure tab to look at filings but sometimes I'll use their Financials tab for a look at the last few years of numbers. Problem is the financials tab doesn't show some things like shares outstanding.

Financials Long Term

The only free site I know of right now that shows long term financials is Roic.ai. It's really great and they go back decades. Unfortunately they do not provide data for all OTC stocks (such as MRCR, HYDI) but it's great for SEC reporting.

Conference Calls

The best site to read conference call transcripts is TIKR. You can sign up for a free account and read all the transcripts your heart desires.

Recent Transactions

One really nice thing for super illiquid stocks is to see recent transactions. The iHub app I mentioned above for charts also will show you all transactions from that day. I look at this pretty frequently during the day as I'm watching trades on all my stocks. If something has been sold in a big chunk you can see it.

Insider Transactions

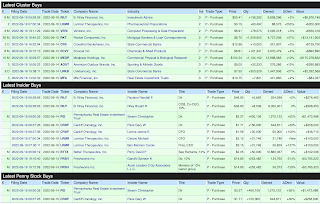

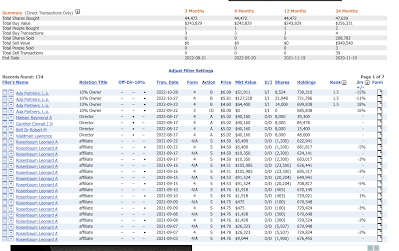

OpenInsider.com is an amazing free site that tracks all things insider buys. You can search by ticker or insider name. You can screen.

J3 Information Services Group is another great free site that shows all recent transactions. You can easily click the link to open the filing and read about the transaction.

Web Archive

The Web Archive stores versions of websites online. It can be useful if you want to know how a company site used to look or if you're wondering when a company changed some aspect of their site. There are also companies out there, like AGTT, that post press releases but remove them so you can use this to look back in time.

State Law and Incorporations

If you want to look up state laws or search for business entities here are some links. You can google around and find other states

If you want to look up state laws or search for business entities here are some links. You can google around and find other states

- State codes:

- New York

- http://codes.findlaw.com/ny/business-corporation-law/

- http://law.justia.com/codes/new-york/2010/bsc

- According to New York’s Business Corporation Law §624, the company must produce for my inspection the following records of QDLC: an annual balance sheet and profit and loss statement for the preceding fiscal year.

- In NY, the Division of Corporations governs business compliance

- Business entity search

- Delaware

- http://delcode.delaware.gov/title8/c001/sc07/

- http://delcode.delaware.gov/title8/c001/index.shtml

- § 220 Inspection of books and records.

- Any stockholder, in person or by attorney or other agent, shall, upon written demand under oath stating the purpose thereof, have the right during the usual hours for business to inspect for any proper purpose, and to make copies and extracts from:

- (1) The corporation's stock ledger, a list of its stockholders, and its other books and records; and

- (2) A subsidiary's books and records, to the extent that:

- § 211 Meetings of stockholders.

- (b) Unless directors are elected by written consent in lieu of an annual meeting as permitted by this subsection, an annual meeting of stockholders shall be held for the election of directors on a date and at a time designated by or in the manner provided in the bylaws.

- Duty of directors

- Business entity search

- Fiduciary duties of delaware directors

- http://corplaw.delaware.gov/eng/delaware_way.shtml

- The Delaware General Corporation Law section 141(a) states, “In discharging their duty to manage or oversee the management of the corporation, directors owe fiduciary duties of loyalty and care to the corporation and its stockholders.” And further, “Although Delaware law gives directors wide discretion to decide how a corporation should seek profit, the duty of loyalty requires them to consider as well what legal, ethical course of action will produce the best outcome for the corporation's stockholders.”

- Connecticut

- https://www.cga.ct.gov/current/pub/chap_601.htm

- CT must have annual meeting. Also 10% holders can force a special meeting.

- https://www.cga.ct.gov/current/pub/chap_601.htm#sec_33-695

- Must allow shareholders to inspect records

- Sec. 33-946. Inspection of records by shareholders. (a) A shareholder of a corporation is entitled to inspect and copy, during regular business hours at the corporation’s principal office, any of the records of the corporation described in subsection (e) of section 33-945 if he gives the corporation a signed written notice of his demand at least five business days before the date on which he wishes to inspect and copy.

- Business entity search

- New Jersey

- Business entity search

- https://www.njportal.com/DOR/BusinessNameSearch/Search/BusinessName

- Massachusetts

- Business entity search

--Dan

Subscribe to all NoNameStocks posts here: https://forms.feedblitz.com/erd

Thanks for the list of tools you use. I'm still in the learning curve of investing and I embrace all the help and advice I can find. Dave B.

ReplyDeleteThanks for sharing Dan. I was wondering how do you keep track of your portfolio? Like you I have been spread across multiple brokerages because of trading restrictions on dark stocks and I do not know how to best track my CAGR and compare it to indexed returns. Do you use a tool or have a custom spreadsheet you'd be comfortable sharing? Thanks

ReplyDeleteIn Schwab I can view all my accounts. It aggregates the Schwab accounts natively and also allows me to add non-schwab accounts. So I added in my Fidelity account and now it totals up my positions.

DeleteAs for the CAGR tracking what I do is use a custom google sheet. I talked about what formulas I use at the end of this post: http://www.nonamestocks.com/2020/04/noname-annual-performance-2019-2020.html

updated June 27, 2024: "Stock Price & News Tracking" and "Filings by email" sections.

ReplyDeleteI use seeking alpha portfolio to watch my stocks and news all day. I use capedge to email me for SEC filings