First a few quick stats:

- 10.7M shares outstanding

- recent share price of $0.30

- market cap of ~$3.2M

- no debt

- high insider ownership (33% as of last 10-K)

Why did they sell off all their divisions and what are they doing now? Bioresearch. The company now describe themselves as:

"HemaCare Corporation (“HemaCare” or the “Company”) is a blood products and services company serving healthcare providers and the scientific community. The Company provides a variety of primary human cells and blood components collected from donors and patients."What does that mean? They sell cells and other donor products to people doing research. Need cells to research a disease, HEMA is your place. Need cells from some specific subset of the polulation, they can do that too. Donors come in, HEMA takes what they need for whatever order, then they ship it out. They say they are "the only supplier with a true, validated, global reach."

Filing status:

The company filed the FY2011 10-k with the SEC in Apr 2012 and immediately afterward stopped filing. The company said they would file financials twice annually on their website and generally have done so. They are behind though, having only filed the 2013 annual report in Apr 2015.

2015 annual meeting:

The HEMA yahoo message board contains a description of what was discussed at the May 2015 annual meeting and it sounds very good for the bioresearch division:

- 2013: Entry into bioresearch. 8 months. Added 109 customers. $1.4M revenue.

- 2014: Added 99 customers. $4.5M revenue.

- 2015: YTD in May: added 34 customers. On pace for "near double" in revs and "substantial progress toward profitability in 2016."

2013 annual report:

There are a handful of items I'd like to highlight. There are positives and we have to keep in mind the financial information is a year and a half old.

Financials

Book value of $5.5M = $0.51 per share. $3.2M cash = $0.30 per share. 0 debt. Had about $4.2M in cash + receivables at the end of 2012 and 2013 ($0.39 per share). NCAV = $0.29 per share. Gross margin for Bioresearch division of 55%.

Apheresis Division sale:

This was announced in Mar 2015 with no details. The 2013 annual report gave more information: HEMA sold the division for somewhere between $3M and $5M. They already have $3M and the final $2M is dependent on transferring accounts over to the new buyer which they say is going well. Today, Aug 10, they should know the final price.

NOLs:

$7M Federal. $6.9M State. Expire between 2018-2033.

Divisions:

They very nicely break out all the various divisions to help focus you on the Bioresearch business. Apheresis made $1.1M gross but the company as a whole lost money as a result of their fixed costs.

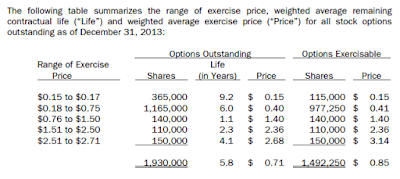

Stock Options:

The company has an option plan and they use it. They granted 140k options at a weighted average exercise price of $0.44 in 2012. They granted 365k at $0.15 in 2013. I don't like the granting of so many options at that low price in 2013 but maybe it's just due to timing and the share price. This is one item to watch in the future but it's worth noting that the number of options is in line with what the company has traditionally done. The 2011 10-K shows 290k granted in 2010 at $0.61 and 260k granted in 2009 at $0.42.

2011 10-K:

Unfortunately the company does not disclose inside ownership in their non-SEC filings. Of course we don't know what has happened since then but there is high ownership as of the last 10-K.

Insider Ownership:

The CEO owns 3.44%. The officers and directors as a whole own 32.87%. Together with other 5% holders that jumps up to 62%.

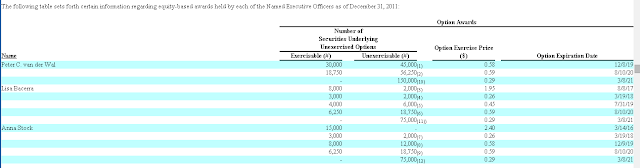

Stock Options:

The CEO's options exercise between $0.29 and $0.59. Overall they exercise between $0.26 and $2.40.

Competitive advantage:

When HEMA started out they had to have FDA approval as a blood bank. This is something they have kept up throughout their operation despite the high associated costs. I don't know too much about this area but I believe at some point in the FDA approval process a company has to use FDA approved research products.

The other thing is HEMA's donor list. They tout this as a big advantage. As they sold off divisions over the years they kept the donor list that goes back decades. They can match donors to customer needs.

Why did they go dark?:

I don't know for sure. I bet they save a few hundred grand per year. I think they likely did this for a combination of saving money and transforming the company in the dark. One reason I'd really like to see insider ownership disclosed in their annual reports is I wonder how many shares they've all bought while the share price was languishing the past few years.

I don't think they did it to start robbing the company while no one is looking but I suppose they could be doing this. They hold annual meetings. They do file results, though not always on time. They are granting options in line with what they did in the past as an SEC filing company. They do not report officer salaries in the latest non-SEC filed reports.

Risks:

Obviously the lack of information presents a risk. The latest filing is an annual report from FY2013 that came out about 16 months after the filing period ended. So we don't know for sure what is going on now.

The company also has not been in the bioresearch space for long. They are growing well and with that comes risk. Can they keep up the growth? How will growth be funded in the future? What challenges lie ahead in this new endeavor?

Why is it cheap:

Whenever I see what looks to be a good deal my first thought is why is this cheap. If I can't figure out why it's cheap then it probably isn't and I should move on. With HEMA I think there are a number of reasons:

- $3.5M market cap

- Does not file with the SEC

- Poor communication

- Not up to date on filings

- Not currently profitable

Conclusion and Valuation:

Let's tie all these little tidbits together. What we have here is a startup which emerged from a similar business. They have paid for expansion into this new business by selling off unnecessary assets. They are experienced in the blood products space. The market views HEMA as the old money losing blood bank business, unaware of the fundamental change that has taken place.

Look at the Bioresearch numbers again from the annual meeting. They've gone from $0 revs in 2011 to $1.4M to $4.5M to ~$9M in 2015. What would you pay for a company growing revenue like this without taking on debt or dilution? Let's say TTM sales is about $6M then this company is selling for 0.5 sales right now. I don't now the bioresearch market size but I imagine it's pretty much infinite versus the size of this company.

So what are we buying when we purchase shares at the current price of $0.30? Well first you get a debt free company growing revs like crazy at 0.5 TTM sales. At year end 2013 the company had NCAV of $0.29 per share and cash of $0.30 per share. They just sold off the Aphaeresis division for between $3M and $5M = $0.28-$0.46 per share.

They said they've made "substantial progress toward profitability in 2016" with around $9M in revenue so I imagine their $4M in SG&A will be staying. If in 2015 they get to $9M in revenue and keep the 55% gross margin plus the $4M SG&A then we'll have $0.09 EBITDA per share. If the revenue growth keeps up in 2016 while margin and SG&A stay similar then EBITDA will shoot through the roof.

Overall I think it's hard to say exactly what will happen a year or two from now and at the same time I think the future looks bright. We have a smart management team that has taken a flat or shrinking company and turned it into cash plus a growing company. The market is not aware of this change as there is no coverage anywhere. The stock price has come up from all time lows over the past year and is still below that which it was as a money losing blood bank a few years ago. Buying has picked up somewhat since the annual meeting in May but volume is still tiny. It might take a year or two to really know what we have and hopefully it'll be worth the wait.

When will the market wake up? The company should be filing 2014 reports at some point as well as reporting on the final Apheresis sale results. If we're lucky perhaps they'll start communicating more with the investment community. They own a lot of stock so I have to think that'll come at some point. Maybe that'll do it.

Disclosure: Long HEMA

Dan, congrats on a great investment here. I've recently found HEMA (at around $3.50) and its a great company with a bright future. I only wish I had read this in August of 2015! Excellent work! Did you find this from another blog and if so, would you care to let me know who the sleuth was to pass the information to you? Cheers.

ReplyDeleteThank you. It was a friend of mine who spends his day reading filings and press releases. He has been doing this forever and had followed HEMA from many years ago. He doesn't have a blog

DeleteI've just discovered this blog and I'm reading backwards, really great stuff.

ReplyDeleteSince this post is pretty out of date- can I ask if HEMA is still cheap?

Thanks. I'm glad you like the blog

DeleteI think HEMA is worth north of $7 with the current numbers and I bet we see double digits within a year. There's just so much good. They are doing all the right things with distribution and expansion into a new facility and growth. The balance sheet looks great. They are earning money now. I hope they will uplist one of these days.

But I personally would have a hard time buying into this after such a big rise. I prefer to buy the ugly and out of favor. Some recent buys for me: GIGA, HCGS, FRTN, SPRS, ESMC

Dan, I like your approach. As far as out of favor, hated stocks, look no further than AIM on the TSX. I think there's value to at least $5 CAD in a couple years. Worth a look if you find the time.

DeleteThanks. I’ll check that out

DeleteWhat do you know about Aimia?

DeleteI am shareholder and would be happy to discuss it.

German, I'd love to know what drew you to AIM and how you view the investment prospects going forward. Did you vote your proxy yet? If not, I wonder if you've considered not supporting the previous board and only voting for the new candidates (Rabe, Mittleman, Edwards)

DeleteHaha, I have voted, yes, but I am a really small fish.

DeleteI am against the old board, because quite honestly they couldn't have done worse. Just look at the recent deal with Sainsburry. They payed up (!) for getting rid of a cash generative business, which they themselves acquired for good money.

SaltShaker - nice call on Aimia. It has really had a good first half of the year.

ReplyDeleteCongrats on this stock. Assuming they sell out around $22/share, that's a ~73-bagger in 4.25 years, representing a CAGR of 175%(!) Well done.

ReplyDeletethanks

DeleteI would have sold this stock much earlier just to collect the return. It is difficult to hold a stock that did go up so much.

ReplyDeleteYou must have nerves of steel...

It just continues to look good so I hold. I have sold some at a few points over the years but still hold the bulk of my HEMA. It remains something like half my portfolio.

DeleteThis is (IMHO) the best way to invest - let your winners run. Obviously, if you buy a stock and it goes up 10X or 20X, the company's board, CEO and upper mgmt are doing a lot of things right. Why sell if you don't have to? Selling not only means you no longer own a company that is firing on all cylinders, but also (A) you have to pay taxes on your gains in the near term and (B) you have to find something else to invest in that has a better risk/reward ratio. People tend to sell b/c of anchoring bias (they compare the market price to their purchase price, instead of comparing it to the then intrinsic value). I can't tell you how many times I've seen smart people sell out for a modest (or even immodest) gain, only to see the stock they've sold go up many multiples from their sale price. See, for example, Tilson and NFLX - he called it perfectly, but shot himself in the foot by repeatedly "trimming for risk control" (he didn't realize that the real risk is not owning a great business run by brilliant mgmt! [aka opportunity cost]). To sum up - as Warren Buffett has said, "Too much of a good thing can be wonderful."

DeleteYes and no. I would not sell for a mondest gain. However, if you kept your "winners" e.g. in the year 2000 after the dotcom bubble, you didn't have much money left after a few months. Everything is simple in retrospect.

DeleteFurther, there are also indications that extreme loser stocks can be quite attractive.

Another example is Amazon. The first employee Bezos hired was a computer programmer named Shel Kaphan. Kaphan owned or had options on over 1 million shares when AMZN IPO'd in 1997 - split adjusted this would be 12 million shares today, worth around $21,000,000,000. So is Kaphan one of the world's richest people right now? No, he dumped all of his stock after he left the company in 1999 after feuding with Bezos about his internal responsibilities (in other words, he lost power to other new hires and quit in a huff). Perhaps Kaphan made $30 million to $50 million on his stock sales; but he would have had to pay taxes on the capital gains (likely at a 20% cap gains tax rate), so his fortune would have been reduced to a range of $24 million to $40 million. Now that's a pretty nice fortune, but it's not even remotely close to $21 billion. All the guy had to do to get ridiculously, phenomenally rich was...nothing, just be patient and hold his stock, but he couldn't help himself and foolishly sold out (largely due to emotion).

ReplyDeletehttps://www.businessinsider.com/amazon-first-employee-shel-kaphan-biggest-lesson-learned-2016-9

Unfortunately, however, many shares also increase in value and then drop again. I have seen this many times. It would only help an investor if you can find the NEXT Amazon. Ben Graham e.g. sold stocks after a price increase of 50% or 100%.

DeleteAt least statistically one could simply hold the smallest 5%, most illiquid and cheapest stocks. The others can also be sold. The performance should be excellent if the past repeats itself.

Selling after a 50% or 100% price increase here would have been an epic disaster...congrats to longs.

Deletehttps://www.businesswire.com/news/home/20191216005321/en/Charles-River-Laboratories-Acquire-HemaCare-Corporation

Yes, I agree with you that related to HEMA it was of course a brilliant idea to keep the stock.

DeleteHowever, the 25 nano stocks (MC < 25Mio.) with the very lowest price to sales ratio e.g. had a average return of 78% p.a. according to the study "A Modified Price-Sales Ratio: A Useful Tool For Investors?", David R. Vruwink, table 1, in a backtest period of 17y. So it seems that this could work too. (I hope that they calculated the return correctly as it sounds incredible).

"However, if you kept your "winners" e.g. in the year 2000 after the dotcom bubble"

ReplyDeleteObviously if you think you are investing in a bubble environment, selling makes sense. But 95% of the time you aren't going to be in such an environment. So your example is the exception that proves the general rule.