A few days ago DYSL put out a tender offer to buy back 54% of their common at $2.49. I first wrote up the stock at $0.81 and my portfolio has been ugly recently so it feels great to have a win.

I'm not sure yet what to do so let's run through some scenarios.

First a chart because it tells the full story. You can see the stock rise in 2013 as the public started to believe in the potential of DYSL's Xcede product. It never took off and you can see the disappointment in late 2018 as the company closed up the division. Volume disappears as the company de-registered from the SEC in the fall of 2019, going dark and vanishing from the public eye. The company continued to send annual reports to shareholders and hence the sudden rise in late 2021 when a record year and subsidiary sale was reported.

For the 9 months prior, the stock was flat at ~$1.25 giving a market cap of $18.5m. Then they reported $6.3m in operating income and sold 2 divisions for $32m! Talk about a blowout. I don't think those divisions were even half their revenue.

Fast forward a year and now we have the $2.49 buyout. DYSL is offering to buy 8m shares which is 54% of the 14.8m shares out. Question is do we take the offer...

In each of my first two writeups I said the stock was worth at least $2 and all along that has been my thinking, so from that point of view I should take the money and run. But we have a couple weeks to think it over so let me check in a little closer.

One way to look at this is value the shares based on most recent numbers assuming the offer is completed. In the tender they geve the most recent 9 months numbers plus a balance sheet so we can use that. There's $28m in cash and DYSL is about to spend $20.5m on a tender so let's say they have $5m excess cash. For a valuation let's say I normalize the 9mo earnings and give it a 10 PE, that makes ~$12m and we add the 5m excess cash. Let's add a few million for the real estate I think they have left and we get $20m for the company = $2.94 per share given the 6.8m shares after the tender completes.

We could also take the balance sheet and just assume book value which is $44.4m. Divide by the current share count of 14.8m shares and we get a value of $3 per share.

If we extrapolate the latest 9mo numbers to 12mo we have $38m revenue. If we go with a 1x sales multiple then add say $25m current excess cash + $3m real estate we get $66m total value ~= $4.50 per share with our 14.8m shares out right now.

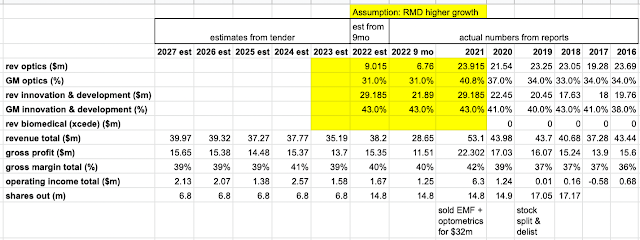

The final valuation method I have in me here is to base on the projections given in the tender. Looks like they predict a fairly stagnant company so I'll just go with $1.5m net income * 10 = $15m for the company = $2.20 per share with our future 6.8m shares out. Or if you say 1x sales that'd be more like $5 per share.

So those are my estimates and it sounds like the $2.49 is not all that far off, though I could see it being a bit higher. Maybe I should just take it and move on. But I'm always thinking about the future and what if. I try to understand the motivation of all players involved.

On the one hand we have what seems like a decent price with the stock at a 10 year high. The CEO is 71 now and owns about a quarter of the company, maybe this is him saying goodbye. Unfortunately the tender offer does not say what the insiders who own 54% of the company intend to do. The stock is on the expert market so liquidity is nothing and it's hard to say when the next chance to get out might be.

But what about that sale of 2 divisions for $32m? That sounds pretty crazy for an $18.5m market cap stock. What if the whole company were worth that multiple?

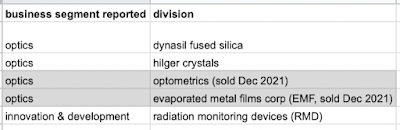

Below are some numbers since 2016 and a description of the divisions vs their reported segments. When submitting 10k's, the company used to break out divisional performance. They had 4 Optics divisions which you can imagine what they do, and one Innovation & Development (RMD) which was mostly a group of research brains for hire. Revenue was about evenly split between the two reporting segments with gross margin a bit higher for RMD than optics.

They sold 2 of their 4 optics divisions, which as a whole had historically lower margins than RMD, for almost twice the market cap of the whole company!

Subscribe to all NoNameStocks posts here: https://forms.feedblitz.com/erd

I ended up tendering all my shares so I'm out now. Just got the tender results and all tendered shares were taken as they did not quite meet their ceiling. Got close though. The offered to buy 8m shares and 7m ended up being tendered so that will decrease share count by 47%.

ReplyDeleteon to other opportunities for me