We finally have HAUP financials! It only took 8 state law DE 220 demand letters, almost 4 years in court, and hundreds of thousands of dollars in legal fees!

It went all the way to the Delaware supreme court if you can believe it, and they ruled in favor of the shareholder: a company must provide financials to a shareholder asking for them and importantly the company is not entitled to enforce an NDA. That's some great precedent!

The HAUP CEO Ken Plotkin fought as hard as he could for years and I don't see why. As a wise man once asked, "Is he a crook or a person in a lousy business just trying to survive?".

Check out these lines from Plotkin's own lawyer!

"the undersigned believes it incredible that the Company will abide by any future Order from this Court or our Supreme Court"

"it is not clear to the undersigned that the Company has any credible intentions of paying the Costs awarded to Mr. Rivest, let alone the outstanding balance owed to Counsel or the appellate retainer"

"The undersigned has advised the Company not to relocate to a different jurisdiction or attempt to move assets, for that may trigger issues sounding in fraudulent transfer. Despite that advice, it appears the Company is in the process of moving, without disclosing its address to the undersigned"Can you imagine?! Your lawyer walks into court and says he's not getting paid, the court won't be paid, his client won't do what you say, and the client is trying to skip town. Insane

But what you want are the numbers. That's what started this thing 5 years ago. Well here they are. In that link you'll find quarterly and annual numbers for 2016-2022. Balance sheet, income statement, cashflow. Unfortunately we didn't get any footnotes or other information.

Here's the 2022 vs 2021 summary

- 3.6m rev in 2022 vs 4.2m in 2021

- net income $93k vs $63k

- book value -11.8m vs -11.9m

- 10.9m shares out

- plotkin owns ~10%

- and he's the company's only director

- stock price $0.0011

- market cap $12k

But look at that book value. What do you think the $8.3m in "accrued expenses" and $5.7m in "accounts payable" means? I'd wager that's how Plotkin is paying himself and one reason he was fighting against releasing the numbers. Would be nice to have accompanying footnotes but alas we are left to guess amongst ourselves.

A timeline:

- April 2018: I first emailed the CFO Jerry to get financials. He gave horrible excuses.

- April 2018: I sent a letter to the SEC and the Delaware State Department of Corporations. No response.

- May 2018: I sent a DE state law 220 demand letter to HAUP. No response.

- June 2018: I wrote up HAUP on my blog

- July 2018: Another shareholder Eric Schleien who runs an investment management firm traveled to HAUP and talked to CFO in person. CFO refused to give financials. Eric files a complaint with the DE and NY secretaries of state.

- Dec 2018: Another shareholder C who runs a fund sends a DE state law 220 demand through his fund. No response.

- Feb 2019: A group of us pay a lawyer to send a DE state law 220 demand. CEO calls the lawyer back and gives Reg FD excuse. No financials.

- June 2019: Eric has his lawyer send a DE state law 220 demand, signed and notorized. No response. Lawyer says this is the first time in his career a company has completely ignored.

- July 2019: Jim Rivest sends a DE state law 220 demand letter. No response

- Aug 2019: I wrote a second HAUP post trying to round up shareholders to get more people behind our cause. I got up to 26% of the common with people I heard from but didn't end up doing any sort of proxy battle.

- Oct 2019: Jim's lawyer sends a DE state law 220 demand letter. No response

- Oct 2019: Jim files the action in the DE Court of Chancery seeking HAUP financials under DE state law 220.

- Apr 2020: HAUP hasn't responded so court finds default judgement in favor of Jim.

- Short lived hurray as the court receives a letter from Plotkin hours later. He responded a day after the deadline, with regular mail, and no lawyer.

- Apr 2020: Jim sends another 220 demand letter for newer financials. No response.

- June 2020: HAUP files motion for relief from the default judgement. They've got a lawyer now.

- Oct 2021: Court trial held. One day trial in front of a Master.

- Jan 2022: Court Master issues report

- Ruling that HAUP must give financials and are entitled to 2 year NDA.

- Company had sought indefinite restriction. Jim argued for none. Master decided on two years.

- Feb 2022: Jim appeals the NDA decision which triggers a new Judge in the Court of Chancery to take a look at the case.

- Sept 2022: Jim files yet another 220 demand letter for newer financials since the process has taken so long

- Sept 2022: Court Judge Laster hands down opinion (see here) in favor of Jim.

- HAUP must give financials and there is no NDA required.

- Oct 2022: HAUP appeals to DE Supreme Court but it's quickly rejected as the lower court action has not concluded yet

- Nov 2022: Judge Laster final ruling in favor of Jim

- HAUP must give financials. No NDA required.

- Short article about the decision here.

- Dec 2022: HAUP again appeals to DE Supreme Court and this time it's accepted for the court to look at.

- Dec 2022: HAUP lawyer says he wants out. Says he's not getting paid, doesn't think HAUP will comply with court orders, and they might be trying to skip town

- Soon after he said payment came but will only represent the company in a limited capacity

- Mar 2023: Court of Chancery filing from Judge Lester telling HAUP and Plotkin personally they are going to be held in contempt and required to pay $500 per day for each day they do not produce the financials.

- Soon after the company finally sends Jim an income statement and balance sheet for 2016-2020. No cashflow, no quarterlies, no footnotes.

- Apr 2023: Plotkin representing himself again. Claims the company lost their quarterlies.

- May 2023: Oral arguments for DE Supreme Court case. See video here.

- May 2023: HAUP held in contempt. Finally gives quarterlies for 2016-2020.

- July 2023: DE Supreme Court case completed. Rules in favor of Jim. Agreed with Judge Laster.

- HAUP must produce financials. Quarterly and annual. Balance sheet, income statement, cashflow statement.

- No NDA required

- HAUP is not 'private'

- see the ruling here

- online article here

- July 2023: At long last all the quarterlies and annual numbers for 2016-2021 received. No footnotes

"Starting with Plotkin’s first letter to the Master, the Company relied on Regulation FD as a basis for resisting Rivest’s inspection request. Because the Company had deregistered, Regulation FD does not apply to the Company...Plotkin did not know that..."Again and again Plotkin tried to play the victim. He claimed Jim's lawyer "Mr Montejo has been insufferable during this litigation". When Jim filed a 220 for newer financials, due to Plotkin dragging out the simple request for years, Plotkin complained " Mr. Rivest will burden the Company (and this Court) with another Section 220 lawsuit, raising the same legal issues of confidentiality recycled in the most recent demand..."

Plotkin had the gall to tell the court Jim should pay HAUP's fees! To quote his lawyer "Instead we see over-agression and a win-at-any-cost mentality. As this approach to litigation represents the worst of the practice of law, a counter-award of attorney fees, costs and expenses to defendent is warranted." OMG is all I can say to that. But when given the chance to scratch, claw, and lie without consequence guess what a jerk choses?

In the end the greatest accomplishment is the precedent set. HAUP tried to argue for an NDA, they tried to hide behind Regulation FD. When the SEC changed rules to kill dark stocks and bring in the expert market HAUP even tried to use that to their advantage. Plotkin and Jerry cried made up stories about lost business due to releasing financials. The courts were having none of it.

Thanks Jim

--Dan

disclosure: long HAUP

Subscribe to all NoNameStocks posts here: https://forms.feedblitz.com/erd---------------------------------------------------------------------------------------------------------------------

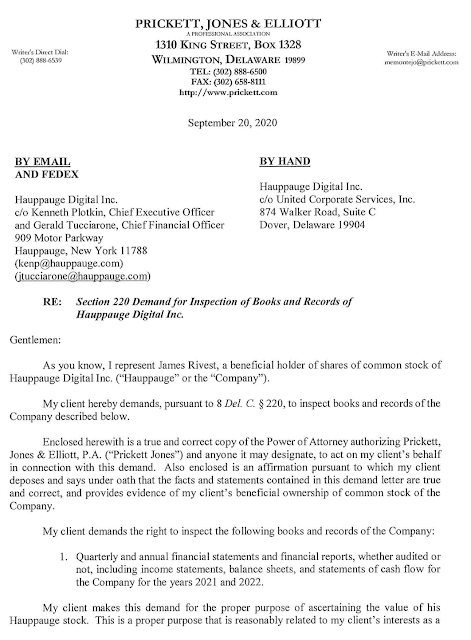

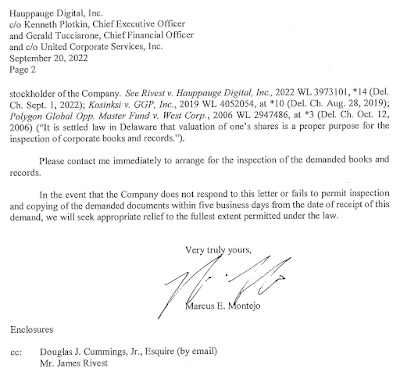

Appendix: One of Jim's 220 demand letters which the court verified shows proper form and purpose

---------------------------------------------------------------------------------------------------------------------

Thanks Dan. What a story!

ReplyDeleteIncredible work Dan. Sad history about justice system.

ReplyDeleteWhat are the chances of voting him out? 10% is not a lot of votes.

ReplyDeletewell that's one reason I was trying to ask for HAUP shareholders to contact me. But I didn't get over 50% and trying to do some proxy battle was just too much

DeleteIt looks like the requirements for still tradable OTC market are not that high. e.g. AMMX makes such statements (see: https://www.otcmarkets.com/otcapi/company/financial-report/379135/content). This is apparently sufficient to be traded via Pink Sheet. If a company does not even manage that, it is not worth investing in, in my opinion.

ReplyDeleteIt is common for civil cases to take years to resolve, though the desperation of the CEO is ridiculous. I wonder whether the CEO really believes his arguments. Perhaps he is a narcissist who truly thinks the company would have thrived under his management if only a competitor hadn't unfairly shown a financial statement to BestBuy, so his ego depends on believing that he must keep the financial statements secret. I also think small investors would be wise to learn how to handle the Delaware Chancery Court themselves. One thing I noted of interest in Vice Chancellor Laster's opinion is that he assumes that there are only three ways for the plaintiff to sell his stock: In the expert market, in the pink market, or in the grey market. Laster assumes -- perhaps the plaintiff said so -- that the plaintiff's strategy is to get information so that he can give it to a market maker which will then publish a price quote, causing the company to switch to the pink market and letting the plaintiff sell. The judge does not consider that the stockholder could sell the same way that any small business owner can sell: by finding a buyer. If I wanted to sell a security barred from electronic price quotations, I would look for a buyer myself rather than pursue a long-term disclosure strategy which might result in a market maker publishing a low price. I wonder whether finding a buyer is what he meant by the grey market. I have never seen a clear explanation of what OTCMarkets means by this.

ReplyDeleteThe justice system works, but you need patience & deep pockets. What's broke is corporate if governance in public companies. They inevitably lawyer-up & make bad faith arguments whenever shareholders try to assert their rights (fiduciary duty to shareholders is simply a foreign concept for most board members). In this case, the CEO seems to be a complete kook, however.

ReplyDelete