Microwave Filter Company (MFCO) filed an annual the other day showing the following per share numbers:

- rev $2.01

- book value $0.76

- EPS $0.10

When I value a stock I generally take the higher of: 10x earnings, 1x revenue, 1x book value. With the latest numbers we would have a value of $1-$2 using that method. 2x - 5x the current share price.

You always have to consider extra items and in this case that's the real estate. They've owned their building for decades and it's fully depreciated. I'm going to go with a real estate value of $3M based on these two excellent write-ups at Elementary Value and Mesaba Range Value.

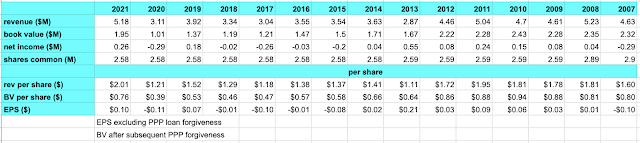

Before we get to a full valuation you have to know some history so here's 15 years of numbers. At least the most important ones. All I want to highlight here is the operating company is stable and alive. It's not dying. (note the 2021 earnings exclude PPP forgiveness and book value is after PPP forgiveness).

MFCO makes electronic hardware filters. Been doing it for decades. I don't know much about the industry other than to say the need for hardware filters is not going away. I don't think the world is going backwards anytime soon. The website advertizes some new 5G filters which sounds exciting!

A description from the recently posted annual report:

"Microwave Filter Company, Inc. designs, develops, manufactures and sells electronic filters, both for radio and microwave frequencies, to help process signal distribution and to prevent unwanted signals from disrupting transmit or receive operations. Markets served include cable television, television and radio broadcast, satellite broadcast, mobile radio and commercial and defense electronics."

I'll say the operating business is worth $3-4M and then we have the real estate for another $3M. Total stock value of $6-7M or ~$2.50 per share. Current stock price is $0.43. Cheap with a capital C.

But you have to ask yourself why am I being given this gift. Where is the disconnect?

In this case it's the SEC. Check out this chart. The stock has been cut in half the past few months since the new SEC rule went into place. MFCO unfortunately did not comply with the new rule and was dropped to the Expert Market leaving few brokerages allowing trades. I'd be buying more right now if I could.

What's interesting is the change. I'm always on the lookout for change. A week ago the company filed their 2021 annual. 4 days later the 2020 annual and most importantly a change from Expert Market to the OTC Markets Pink Limited Information Tier!

That's right, the stock is going to be tradeable again. I expect the stock to be back closer to a dollar once the brokerages allow trading. Question is when will that happen. I don't know what the lag time is between otcmarkets tier change and online brokerages recognizing that status. Schwab at least still doesn't let me buy even though MFCO has met the SEC rule guidelines for a few days now.

I own the stock for two reasons: it's cheap and potential is high. I want big stock movement and all the signs are there. The stock is illiquid with only 2.6M shares out. Near zero debt, no warrants, no preferred, super clean capital structure. The company is not going anywhere. Share count stable for many years. No way the stock is worth less than 3x the current price.

But really all you need to know is here in this chart. We are at the bottom. It's low and forgotten and lonely. Look at that spike...it could happen again

--Dan

disclosure: long MFCO

I strongly recommend you read the 2019 write-ups at Elementary Value and Mesaba Range Value.

Great post Dan.

ReplyDeleteHope the Sec listen to retail investors.

Happy new year!

I saw a bunch of activity on this did Schwab open it up or is it a different broker allowing trades?

ReplyDeletecouple people told me Fidelity and Etrade allowed them to buy. so it seems Schwab is slower to react

DeleteJust got off the phone with Schwab. I am allowed to buy MFCO right now with schwab but I have to call it in because their system hasn't updated itself yet. They're not real sure how long it takes but told me check again in a few days. What's interesting is when I called in to place the trade the first thing the Schwab person does is open up otcmarkets to check the tier status. So I called and this woman puts me on hold while she opens up otcmarkets and that's how she decides if she's able to put in the trade

DeleteDude! Missed buying! MFCO 0.9500+0.5200 (+120.93%)

ReplyDeleteAt close: December 31 01:51PM EST

I'd bet it'll drop back down at some point

DeleteIs there any way to buy these dark stocks now?

ReplyDeletewell MFCO is not dark anymore so many brokerages can trade it: fidelity, schwab, etc. MFCO is on the Pink Limited tier at otcmarkets

Deleteas for dark stocks here is what I have heard. You should call them as things are changing and all of this is what people told me, not what I confirmed myself.

Delete-non-americans can open an account with Questrade

-in the US there's some full service brokerages. They have higher fees, you have to call in trades, higher account minimums, etc. Robotti, Centerpoint Securities, Caldwell Sutter, Janney, Hilltop Securities.

MFCO reported quarterly results last week. Sales up about 4%, but a small loss since SG&A was up almost 32%. I wonder what accounted for that increase.

ReplyDeleteYes, boring Q and now waiting. I dunno about the SGA

DeleteWhere did you see the recent quarterly results for MFCO? Their website still only showing quarter ending 12/31/21 as the latest. Thanks.

Deletehttps://www.otcmarkets.com/stock/MFCO/disclosure

DeleteThank you.

DeleteHey Dan, do you still see this as a potential buy at current price?

ReplyDeleteSorry somehow I missed responding to this. The story is the same now as it has been. lots of potential and the question is will they be able to grab it. They released earnings recently and it was another nothing. Someday...

DeleteMFCO just posted a new company profile to their website. nice to see. https://www.microwavefilter.com/guide/

ReplyDelete